Table of Contents

ACKNOWLEDGEMENTS

We would like to thank the following people who graciously spent time answering our questions and sharing their expertise to help inform our research:

| Jerry Akers Entrepreneur who offers child care benefits to employees | Suzanne Schreiber Oklahoma State Legislator |

| Jane Alexander Former center director | Dan Teefey Executive Director of Tracy Family Foundation |

| Cindy Decker Executive Director of Tulsa Educare | An early ed program director who prefers to remain anonymous. |

| Chris Herbst Associate Professor of Education at Arizona State University |

Executive Summary

Child care plays a key role in sustaining a productive labor force, but the current child care system is not meeting the economy’s needs or serving young families well.

This report examines state-level data to determine how efficiently each state turns child care funding into accessible, affordable, and high-quality care. We measured technical efficiency as the total of all three outputs simultaneously relative to the child care funding going into the system. We then explored which state policies are associated with more efficient child care systems overall and the production of each output individually.

Through our research, we found several state policy decisions appear to influence the efficiency of the combined child care outcomes. The data highlight underfunding of child care programs as the one policy metric that reduces efficiency across all three outputs when they are measured individually.

Many states can improve their efficiency by utilizing the federal Temporary Assistance for Needy Families (TANF) funding for child care, allowing voucher limits that cover the cost of quality care, and providing child care subsides with a co-pay for a wider income range.

- All states can become more efficient by focusing on action that increases the supply of child care. This includes policies that

- Streamline regulations between the state and local levels

- Support public-private partnerships that allow child care providers to minimize costs

- Allow child care workers to participate in tax credits or child care vouchers regardless of household income

- Encourage strategies that allow small and mid- size employers to offer child care benefits

- Support professional organizations that assist home care providers

- Accelerate education pipeline for Pre-K and early education to increase the supply of qualified teachers

Introduction

The economic case for improving efficiencies in the child care market

A shortage of professional care givers for children prevents many prime-age adults from working. While parents need to support their families, they can only work full-time hours in most occupations when they have access to reliable and affordable child care.

The issue took on even greater urgency during the pandemic, and the U.S. allocated $39 billion in supplemental funding to keep child care providers open.1 The supplemental funding expires at the end of September 2023 with more than 3 million children projected to lose access to care and 70,000 programs likely to close.2 Even with the supplemental funding, a recent report by the Annie E. Casey Foundation suggested about 13% of children under age five had parents who had to switch jobs or resign because they did not have affordable child care arrangements that coordinated with their work schedules from 2017–2021.3

Americans love free markets almost as much as we love our kids. We trust market incentives to solve tough allocation issues in our complex economy. We rely on markets to produce the goods and services people most value, to reward businesses with good ideas who take smart risks, and to motivate people to work hard and master the most challenging and valuable skillsets. Only in rare cases do we support interfering with markets, though child care is one such case.

A robust and reliable market system allows middle- income families to benefit from services that were regular household tasks; effectively outsourcing work such as lawn care, cleaning, meal preparation, and helping kids with their homework. Unfortunately, when it comes to caring for kids while their parents work, the market is letting us down. It’s time to admit the market needs some attention so we can get serious about finding solutions that allow parents to be reliable employees and business owners.

Affordability, Accessibility and Quality

We need child care that is simultaneously affordable, widely accessible, and high-quality. If the care is not affordable, parents in low-wage occupations will not net enough income and will opt out of the labor force. We need widely accessible options so parents can find a spot that best fits the needs of their work schedule and their child. And we need high-quality programs to help close the achievement gap between disadvantaged and better off children that emerges long before kindergarten.

Even the brightest and most well-connected entrepreneurs have not provided a market solution at the scale and price point needed to offer viable solutions for working-class families4 without broader adjustments to the market.

An affordable rate to the families who need child care does not cover the costs of paying child care workers a living wage, which makes it difficult to attract and retain highly qualified teachers and caregivers. But quality child care requires hands-on attention from human caregivers.

Others have examined how and why private markets do not work for child care, which is beyond the scope of this report.5 Instead, our research focused on how efficiently states use funding to create accessible, affordable, and high-quality child care and what they can do to improve.

The Benefits of Better Care

Parents, particularly mothers of young children, are more apt to work outside the home when they have access to affordable, high-quality childcare – improving child care is an important part of any strategy to increase our labor force. Providing public dollars for child care costs increases maternal employment more than increases in the minimum wage, but not as much as increasing the earned income tax credit.6 Expensive child care and short school days are well-documented barriers to maternal employment.7 A review of the research suggests labor force participation of mothers in the U.S. could go up as much as 11% if child care costs were 10% lower.8

The benefits of providing additional funding for child care, however, go beyond mothers’ labor force participation. The quality of educational experiences in early childhood also influences the cognitive ability, academic achievement, and other important outcomes later in life.9,10 Research estimates our pre- school programs in the U.S. narrow the achievement gap by about 5% but could reduce the gap by 30– 50% with consistent high-quality programs.11

Head Start, for instance, is a pre-school program for 3- and 4-year-olds that is designed to help close the cognitive skills gap before kindergarten and to try to mitigate some of the negative life outcome associated with being raised in poverty. It provides additional services and coaching for parents and has been shown to be effective in improving high school graduation and health outcomes later in life,12,13 particularly when it is followed up with high quality

K-12 educational experiences.14

High quality care with an intentional educational component does more to close the skills divide than lower quality or less cognitively focused care that simply keeps children safe and cared for. A study using program changes to measure the impacts on children in England found that more time in daycare, as well as attending a higher quality center, increases the probability of being on track academically at ages 5 and 7,15 when quality is determined from facility inspections rather than teacher credentials.

This creates additional value to any programs that specifically help more children from low-income households spend more time in high-quality care facilities. Unfortunately, many of our systems fail to consistently place lower-income children in high- quality programs.

Programs such as Head Start are not new. The U.S. government has focused on early childhood for more than four decades.16 Researchers have studied the effectiveness of different strategies for addressing the early childhood care market and the possibility of unintended consequences. Chris Herbst17 summarizes the research findings on how these programs are influencing a variety of important labor force and achievement outcomes. In general, he found that mothers receiving child care funding were more likely to be employed without receiving welfare benefits and more likely to work standard daytime shifts. He also found that high-quality programs improve the academic performance of children, but spending long hours in low quality care leads to lower academic performance in kindergarten. Isabel Sawhill, a senior fellow at Brookings, has recently written in favor of Head Start as an alternative to lower quality child care.18

Searching for Solutions

The Household Pulse Survey19 from September 2022 through April 2023 showed 1.3% to 7.6% of adults in each state were missing work to care for children, and a recent report by the Society for Human Resource Management estimated inadequate child care causes $37 billion in lost wages and $13 billion in lost productivity for employers each year.20 The Biden administration issued executive orders21 in April 2023 that were intended to bolster the child care industry, improve job quality for child care workers and to cap what low-income families are expected to pay for care.22

In addition to the executive order, the tight labor market has prompted employers to recognize they have a vested interest in their employees having access to reliable child care arrangements.23,24,25 The federal government is also encouraging employers to consider child care access: The CHIPS and Science Act of 202226 requires tech firms to submit plans for employees’ child care access to qualify for larger grant requests.

The collective wisdom is that child care is a complex, multi-faceted issue that will take government, private and philanthropic cooperation to address effectively. The next section discusses some of the market interventions that are influencing the quality and availability of child care. Then we evaluate how efficiently the current system works in each state and identify policy choices associated with different outcomes. We conclude with policy recommendations to improve the outcomes of our child care infrastructure.

Market Interventions and Outcomes

Market interventions are designed to bring about a specific outcome, such as lower prices or a greater number of providers in the market, but they also make some players better off and others worse off.

For instance, when low-income households receive vouchers to pay for child care, families have the money they would normally pay plus the voucher to help cover the cost of care, enabling them to afford higher quality care. The voucher increases the demand for child care services and drives up the price for everyone. Low-income households are better off, while those who do not receive the voucher are worse off. These types of policies may increase the number of providers indirectly, but only because they are responding to the higher revenue generated by customers who are now willing to pay higher prices.

Market Interventions

Market interventions are increasingly common. When society decides it does not like how the market allocates benefits to the players, we implement policies to improve the outcome. For example, we outlaw markets that have damaging byproducts or impose additional social costs such as heroin, prostitution, and dog fighting.

Regulations often restrict entry into some markets, as when certain occupations are required to attain a minimum level of education or skills (verified in the form of a license or certification) like insurance agents, nurses, electricians, attorneys, and truck drivers. Packaged foods must have nutritional information and ingredients listed on the package, and pharmaceutical drugs must pass rigorous testing before being offered.

In other markets, we regulate the behavior of firms in addition to restricting entry. Restaurants and hospitals must pass health inspections consistently, banks’ financial situations and operations are highly regulated, and large trucks must check in with the department of transportation to verify compliance with safety regulations. These types of regulation serve to increase the cost of producing the product and reduce the market supply. This ultimately increases the price of the product, but we benefit nonetheless because consumers can purchase with confidence knowing that quality has met an acceptable threshold.

We also intervene in markets to assist low-income households who cannot afford to buy the goods and services needed to care for their families. We do this through a variety of government programs including SNAP (Supplemental Nutrition Assistance Program), Medicaid, free school lunches, Section 8 housing vouchers, Pell Grants, TANF (Temporary Assistance for Needy Families), and child care vouchers. These types of assistance increase the demand for the product causing a larger quantity to be consumed but also potentially increasing the price of the product for all consumers.

Market interventions also have resulted in a complex U.S. income tax system. We have tax incentives and penalties intended to change the effective prices and alter the market choices of consumers and producers. Examples of such incentives are income tax credits for making energy efficiency improvements to buildings, the tax deduction for interest paid on home mortgages, and the tax penalty for early withdrawals from retirement plans.

In the child care market, there are flexible spending accounts that allow parents to pay for child care costs with pre-tax dollars and tax credits for care paid with after-tax dollars. While significant, the markets interventions in child care markets are not unusual in modern market-oriented economies. Yet despite the current interventions, the market is not working for many working families.

–

Policies in the U.S. income tax code also increase the demand for child care. The child care tax credit and flexible spending accounts that allow families to pay for child care with pre-tax dollars, effectively lower the cost of child care. This makes families willing and able to pay a higher price for child care if necessary. To some degree the earned income tax credit and tax credit for dependent children have a similar effect, but these increase the income of modest income households with kids whether they pay for child care or not. They can use the extra income for child care or anything else the household buys.

Other market interventions influence the choices made by producers. Policies that reduce the cost of operating a child care facility, such as granting them non-profit status (eliminating some taxes), also work to increase the number of child care openings without increasing the price charged in the market. Policies that increase the supply of child care include favorable tax policies for businesses that open child care facilities on site, tax credits for child care workers, state funded, all-day universal pre-K programs, and reducing regulatory burden or administrative requirements on licensed care centers.

Market interventions may also reduce the supply of child care when firms are required to incur additional costs. This can take the form of rigorous building safety codes, limits on capacity, teacher training requirements, and the costs for documenting compliance with regulations. While these regulations are enacted to improve the quality and safety of child care, they have the unintended effect of reducing the accessibility and increasing the cost.

Tracy Family Foundation

In 2018 the Tracy Family Foundation surveyed the residents of Brown County, Illinois to gauge public opinion about what amenities would add to the quality of life and improve the infrastructure of their charming and vibrant small town. The survey revealed a severe shortage in child care options. Most families relied on home care at the time, and, as caregivers resigned or retired, no new home care providers were added to meet the needs of young families.

Despite no background or expertise in child care, the Tracy Family Foundation began researching the market situation and exploring solutions. They ultimately formed a new non-profit organization to operate a child care center, spent nearly $2 million to buy and renovate a building, and contracted with the local YMCA to provide staffing and manage day-to- day operations for the center.

“Our goal with the Brown County Early Learning Center is to provide high-quality early childhood education in Brown County, boost kindergarten readiness and ultimately help make Brown County a community where more people want to live and/ or work,” said Dan Teefey, Tracy Family Foundation executive director. The Tracy Family Foundation subsidizes the center with more than $300,000 annually (over $4,000 per enrolled child!) and offers scholarships to modest-income families who apply and qualify. The Center also participates in the state child care subsidy program, which provides tuition assistance for low-income families.

“My mom and inspiration for the Tracy Family Foundation, Dorothy Tracy, was a teacher, and believed that education and opportunity go hand- in-hand,” said Jean Buckley, TFF board president. “Given the importance of early learning and the need for child care in Brown County, we’re excited that this dream has become a reality.

This is one of the communities across the nation where local philanthropy has stepped up to help close the gap and meet the needs of the local workforce. While subsidized non-profit centers exist in most regions, they are almost always insufficient to satisfy all of the need for child care.

–

The primary market intervention for child care is a federal government block grant to each state for child care assistance. Each state determines how to structure their program. They can provide vouchers that cover the full cost to the families with the lowest incomes or expect families to cover part of the cost through a co-pay and offer partial vouchers to a larger number of families. States can also allow child care assistance for parents who are looking for jobs or attending training or restrict them to parents who are employed and working.

Within the program, states must have a publicly available child care quality rating system, but the state chooses how high the standard must be for child care providers to accept vouchers and whether to pay higher rates to higher quality providers. These choices within the state’s child care assistance program influence how many children can be cared for in different care arrangements and what price the families will pay for the care.

The table below shows how different market interventions affect the supply and demand of child care and how that translates to price and availability of child care. As you can see, the ideal market interventions increase the supply of child care; they result in more openings and lower prices. Those listed in black are already in place to some form in most states. Those in red are less readily employed but are being considered and proposed as helpful polices to implement.

MARKET INTERVENTIONS AND INFLUENCE ON PRICE AND ACCESSIBILITY

| DEMAND | SUPPLY | |

|---|---|---|

| INCREASE | Higher Price, More Openings Needed

|

Lower Price, More Openings Provided

|

| DECREASE | Lower Price, Fewer Openings Needed

|

Higher Price, Fewer Openings Provided

|

Measuring Market Outcomes

Availability, affordability, and quality are somewhat competing outcomes that characterize our child care system. We want an abundance of openings and schedule flexibility to facilitate labor force participation of parents. We also need centers that provide affordable care for working parents. And we need this affordable care to be of high-quality. We want our children cared for in safe, stable, and nurturing environments with stimulating educational experiences that promote the basic academic skills they will need as they enter kindergarten.

Achieving all three simultaneously is not easy and seems insurmountable. Efforts to improve the quality and accessibility of child care tend to increase costs and make it less affordable. Policymakers must balance which aspects of the care system to support, potentially at the expense of one or both of the others.

Since many policies regarding child care funding and safety regulations are determined by the state, we explored state-level data to evaluate child care outcomes. We constructed a child care efficiency score using a statistical method that compares each state’s outcomes (availability, affordability, and quality) to determine those that get the most outputs relative to child care funding.

Childcare on Campus

After a decade of proposals and various attempts to get support, a small, public university opened a child care center on its campus this fall. The center caters to students and staff at the university, and they expected many of the participating families would qualify for state subsidies. Since the state pays more for attendance in centers with higher quality ratings, they intentionally hit all the benchmarks to qualify for the highest state reimbursement under the assistance programs. The state reimbursements are based on the average cost across the state and this college is in a lower cost part of the state, so the rate is higher than the local market prices. They planned to set their fees to get the highest reimbursement allowed from the state even though college employees who do not qualify based on income will effectively be priced out of the center.

These state policies align with incentivizing centers to accept vouchers and provide high-quality care for children in low-income households. This scenario also highlights challenges with setting statewide reimbursement policies when there are vastly different economic conditions in localities around the state. The ideal policy for one region may have unintended consequences in other parts of the state; however, addressing unique situations in each locality is administratively complex and costly.

The person we spoke to acknowledged the many rules and regulations that make opening a new center a challenge, but they are logical and based on child safety, so she had no complaints about complying with myriad regulations. Her bigger challenge was getting the college administration to agree to having minors on campus, since the center is using a refurbished campus building. In addition to the financial commitment, the presence of minors increased the risk exposure of the campus in ways that caused them to consider carefully before approving.

This conversation reinforced two themes that have emerged in researching child care. One is that opening a child care center is complicated, but the challenges may come from surprising sources. The second is that the structure of a state’s child care assistance or voucher program can influence the behavior of households and child care providers in a market.

–

It is important to evaluate how well a state performs on all three outcomes simultaneously since all are important, and a system that does not provide all three is not serving its citizens well. Recognizing that child care outcomes are complex to achieve, we measure each of these outcomes as the average of four different standardized metrics. A detailed description of the data and techniques used are in the technical appendix.

This efficiency measurement technique allows us to see how states are delivering on multiple child care outcomes at the same time relative to the resources used to produce those outcomes. To measure resource inputs, we look at the money that goes into the child care system from a variety of sources.

We used federal, state, and local funding of pre-K programs per young resident. We also include the state funding of child care for lower income households. Since philanthropy fills the gap in many communities, we measured the grants from charitable foundations that go to early learning programs. Households pay most child care costs, so we included the amount families spend on child care as reported on the Household Pulse Survey waves from September 2022 through April 2023.27

Once the outputs and inputs were measured, we calculated efficiency scores that represent how effectively states use the resources to generate the three child care outcomes relative to other states. We assumed the most efficient states operate optimally and measured how different each state was from the most similar efficient state.

We ran the efficiency analysis eight times using different assumptions regarding the rates at which inputs produce outcomes and the statistical method. We also consolidate some funding sources to run a simplified model. In each of the eight efficiency models, we identified the same 11 states as being the most efficient and therefore labeled them as “gold”. We grouped the remaining states into silver and bronze categories based on how far they are from the most efficient states; the silver states are closer than the bronze states to the efficient, or gold, states. The states in the chart are listed alphabetically by category.

State Childcare Policies

| GOLD | SILVER | BRONZE |

|---|---|---|

| Alabama | Arkansas | Alaska |

| Idaho | New Hampshire | Montana |

| Louisiana | California | Arizona |

| Mississippi | North Carolina | New Jersey |

| Nebraska | District of Columbia | Colorado |

| Nevada | Oklahoma | New York |

| New Mexico | Florida | Connecticut |

| North Dakota | Texas | Ohio |

| South Dakota | Georgia | Delaware |

| Wisconsin | Utah | Oregon |

| Wyoming | Indiana | Hawaii |

| Virginia | Pennsylvania | |

| Kentucky | Illinois | |

| West Virginia | Rhode Island | |

| Maine | Iowa | |

| Maryland | South Carolina | |

| Michigan | Kansas | |

| Minnesota | Tennessee | |

| Massachusetts | ||

| Vermont | ||

| Missouri | ||

| Washington |

Next, we collected demographics and policy characteristics and analyzed the data to see which policies are more closely aligned with a state being more efficient. We used a model selection process to identify characteristics and policies that are associated with the overall efficiency of the state’s child care system. All 58 data points collected and evaluated for each state and more details about the statistical technique are provided in the technical appendix.

Overall Efficiency

Six of the 58 policy measures we considered were associated with the observed efficiency of all three child care outcomes when evaluated simultaneously. The more efficient states tend to use TANF funding for child care, provide child care vouchers to parents attending job training, have historically provided vouchers in line with provider costs and do not have state funded pre-K programs. States tend to have less efficient child care systems when they provide vouchers to parents attending high school and require fewer than 15 hours of work to participate.

We aren’t saying pre-K programs are an inefficient state expenditure. Our analysis evaluated the child care infrastructure that allows parents to work. Pre-K programs help prepare children for kindergarten but are generally not full-day or year-round programs that best accommodate parents with jobs. We included state pre-K funding in the child care analysis, since private centers are likely serving the same role in states without publicly funded pre-K.

Individual Child Care Outcomes

In addition to measuring overall efficiency of the three outcomes at once, our research estimates the degree of inefficiency in each individual outcome for the less efficient states. We found that one characteristic negatively influences each of the outcomes when measured individually: underfunding. According to the 2023 Child Care and Development Block Grant (CCDBG) State Fact Sheets,28 the percentage of eligible children who do not receive public funding due to a lack of funding ranges from 73% to 94% with an average of 88%. These statistics are staggering. In the best-funded states only about one in four eligible children is served by the state funding. In the least well-funded states, it’s about one in 17. From our analysis, the higher the rate of underfunding the less efficient the state is in providing quality, accessible, and affordable child care.

State policies that determine which of the eligible families get them may have more influence than the eligibility rules when underfunding prevents most eligible families from receiving assistance. While we have information on family or child categories that are prioritized for assistance, we do not have any information on the procedures by which households get on the waiting list or document eligibility. This lack of information prevented us from exploring how the state funding determination process influences the outcomes. The discussion that follows should be understood as policies that matter in addition to the pervasive underfunding.

Affordability

States with better affordability measures tend to have a larger percentage of children who are eligible for assistance and home care providers that are less organized or professionalized.

States tend to have less affordable care when a larger percentage of children need non-parental care, generating higher demand. States are also less affordable when vouchers are approved for parents receiving basic education and performing job search activities, vouchers continue for longer periods after parents lose jobs, and state funded pre-K programs include 3-year-olds.

Accessibility

On average, states have more accessible child care when the state program requires a local match, approves vouchers for parents seeking job training, prioritizes special needs children, and when the state has a large percentage of children without a stay-at- home parent.

States tend to have less accessibility when they allow vouchers to be used by parents attending high school and require more than 15 hours of professional development for child care workers.29

Quality

States that require in-person observation as part of the child care quality improvement plan and states that allow vouchers to be used by parents seeking higher education tend to have higher quality measures.

States tend to have lower quality when they approve vouchers for parents completing GED or ESL classes, prioritize only very low-income households and only exempt families in poverty from co-pays.

Child care centers vs. Home care

Some families rely on informal or non-market types of care when parents are working. This could be a grandparent or neighbor who cares for the child with or without payment. It is someone the parents trust and know personally, but not a certified child care provider.

Most parents use more formal child care market transactions to arrange for child care while they work. The two most common types of child care providers are child care centers and home care providers.

Child care centers are businesses that care for kids. They are registered with and regulated by the state for safety and quality. They typically care for infants through pre-K aged children and may offer after school or summer care for elementary students. The children are grouped into classrooms based on age and developmental milestones and move from room to room as they grow and mature.

With centers, parents have an agreement with a business rather than an individual, and the agreement continues even as staff at the center turn over. They offer the benefits of continuity as individual care givers resign and are replaced, and they are available year-round and have back up personnel when individual workers are ill or otherwise unavailable.

Home care or family care providers register with the state to provide care for children in their home. The state certification ensures a background check and home inspection and that the care provider has met the state requirements for training. The parents may know the provider personally, gotten a recommendation from a friend, or found the provider on websites or state lists of certified care providers.

Home care providers typically only care for five to 12 children with one or two assistants. Children are consistently cared for by the same one to three people and may interact with children who are a little older or younger. Many families prefer for their child to be cared for in a home environment by the same person over many months or years. However, home care providers may not have a back-up plan when the caregiver is ill or wishes to take vacation, which can create a scheduling challenge for parents.

Child care centers typically cost more than home care providers and are run by professional managers with standard accounting of revenue and expenses. Home care providers are more likely to be women who enjoy caring for children and have little, if any, formal business training. They may not keep formal accounting statements or organized financial information of their operations.

Home care providers are the primary child care providers in some rural areas where the market is not robust enough to support larger child care centers. The number of home care providers has shrunk in recent years as providers retire or choose other employment more frequently than new home cares open.

Since home care providers are an important part of the early care infrastructure, many regions have formed alliances to help train home care providers in business practices. Whether it’s an app that allows them to better track finances or a network of professionals to share best practices and referrals, the potential benefits of the alliances may help stabilize the fragile child care systems and reduce the number of families who find themselves in child care deserts.

Conclusions

Some aspects of program design influence how efficiently the child care system in a state works. Extreme underfunding harms the child care system and outcomes. The larger the degree of underfunding (as measured by children who are eligible for vouchers but do not get them) the greater inefficiency on all three measures of child care outcomes.

States that allow child care vouchers to be used when parents attend higher-level training programs are more efficient than those that only allow them to attend lower-level training. Given the pervasive underfunding of voucher programs, it is possible parents pursuing higher level training are better equipped to navigate a complex system to obtain the vouchers and will be focused on the quality of the program rather than just the lowest cost.

While having a pre-K program appears to make states less efficient, programs with operating hours similar to work schedules and that operate year-round may improve employment more than current program structures.

While our methodology does not prove that the policy choices cause the related outcomes, the fact that policies change infrequently, were established prior to the measured outcomes and the relationships are consistent suggests the policies are likely contributing to the outcomes.

Improving Silver and Bronze States Based on the Research

Based on our analysis, outcome improvements can be achieved by redirecting child care funding. This would allow states currently in the silver and bronze categories to move closer to the gold states which are the observed best-practices frontier.

- Prioritize child care funding and modify public pre-K programs to meet needs of working parents.

- Target reimbursement limits to cover quality child care programs.

- Utilize sliding scale co-pays based on income to prevent abrupt benefit changes for working families.

- Allow Temporary Assistance for Needy Families (TANF) funding for child care; this is associated with better overall child care outcomes.

Parents in the gold states struggle with finding and paying for ideal child care arrangements and would emphatically assert the need to improve upon the current best practices. Getting all states to the performance of the current gold states will not provide the child care system working families need.

Policy Recommendations to Move Toward Platinum: Elevating child care in all states

As we consider changes that will expand access to affordable child care, we need policies that will increase the supply of child care or reduce the cost of providing services without compromising the quality of care.

This is a complex problem that will require coordinated efforts from public, private, and philanthropic decision makers to achieve the child care infrastructure we want. Some of the more promising policies we have seen suggested or implemented are shown below.

- Streamline regulation between states and localities for safety and capacity of child care providers.

- Support public-private partnerships such as utilizing churches and other public spaces for daytime programs. Sharing an existing space allows a child care provider to operate at a lower cost than if it must build or lease space.

- Tax credits or child care vouchers for childcare workers should be independent of income qualifications. Households make decisions to work based on the costs and benefits of each parent working. Parents working in child care generally make low wages, so if we deny incentives to workers with highly paid spouses, they will logically choose not to work. However, one additional child care worker typically allows the facility to care for five or more children, depending on the age of the children. Any incentives targeting child care that make work more beneficial should increase the overall number of child care openings in the system and not be withheld based on other sources of income.

- Encourage employer-provided child care benefits and facilitate strategies that allow small and mid-size businesses to collaborate on offering child care benefits. Employers of all sizes should be able to use child care assistance as a benefit to attract and retain workers in a competitive labor market. Any strategy to minimize costs will increase the financial returns to the firms that do so and further expand the number and quality of employer sponsored programs.

- Support home care providers by implementing systems that facilitate business efficiencies, such as adopting digital wallets and funding professional organizations to promote best practices.

- Accelerate teacher pipelines for pre-K and early education programs. States facing teacher shortages are providing supplemental funding and authorizing new training alternatives to increase the supply of K-12 teachers. Since potential teachers likely consider kindergarten and early education to be highly similar occupations, the current programs might increase K-12 teacher supply while reducing early ed and pre-K teacher supply. Adding educators at all levels to the enhanced funding and pipeline alternatives will increase the number of early education teachers and child care supply.

| PUBLIC POLICY | PRIVATE EMPLOYERS | PHILANTHROPY | |

|---|---|---|---|

| Streamline regulation | |||

| Facilitate Public/Private Partnerships | |||

| Child care worker incentives should NOT depend on household income | |||

| Encourage and facilitate child care benefit strategies for small and mid-size employers | |||

| Support home care providers with business efficiency aids | |||

| Approve and fund accelerated pre-K teacher pipeline programs |

OK HB 2452

Licensing regulations for child care facilities in general are good policy and reduce much of the parental burden of gathering information when choosing where their child will be cared for when not with the parents. While regulations are intended to make sure children are cared for in a safe environment, extreme regulations and excessive compliance requirements may serve as a disincentive to daycare operators and lead to fewer licensed care providers in an area, particularly people who care for a small number of children in a home environment.

States, counties, and cities have all played a role in regulating the operations of child care providers within their jurisdictions. These multiple jurisdictions occasionally create redundant or inconsistent guidelines that add to the complexity and administrative burden without making the children any safer. Suzanne Schreiber, a state representative in Oklahoma, proposed legislation to help minimize the bureaucratic layers home care providers face. HB 2452 passed into bill in March and prevents city or county agencies from overriding DHS authorization for the number of children cared for in the home. According to Schreiber, the state level experts are best qualified to assess the quality and capacity of the home care provider, and it adds unnecessary red tape when cities require additional approvals. It is unfair to ask care providers to attend hearings requesting exemptions from local policies to be able to operate at the capacity for which the state has already licensed them.

If the state certifies a home for 10 children and the city says they can only care for seven, the city regulation represents a 30% reduction in revenue for the provider. To care for seven children, they would still need to employ one assistant, so the cost savings in this case are minimal relative to the loss of revenue. In an industry where the profit margins are close to zero, this reduction is revenue makes the business unprofitable. Even if they city allows the provider to attend a hearing to request an exception, they are unable to care for children and lose revenue every day they attend a hearing in addition to inconveniencing the working parents who rely on the provider. If the appeal is sure to be approved, it is a waste of time to require the provider to attend. If the appeal’s outcome is uncertain, fewer people will choose to be home care providers.

HB 2452 only applies to capacity, or the number of children who can be cared for at once. Cindy Decker, with Tulsa Educare, sees potential benefits for home care providers if states limit the ability of localities to add regulations on other aspects of their operations as well, such as prohibiting a home from having an employee who does not live in the house or requiring the home reside on a larger than typical lot.

–

While some communities have successfully addressed the local child care crisis, it remains a challenge to labor force participation. With the demographic changes projected to shrink the working age population in the U.S. for the next two decades, any issue that impedes labor force participation is a challenge to continued economic growth. Solutions to affordable child care would not only allow more parents to work now, but it also might give young families the confidence to have additional children knowing they can afford to meet all their children’s needs. Enhanced child care is not only an investment in the future workforce of this country, but one that gives parents genuine choices for supporting their families and caring for their children.

Jerry Akers

Jerry Akers owns several small businesses in Iowa and noticed many employees, especially females with children, were not able to come back or work as many hours per week after the COVID pandemic. Realizing unresolved child care issues were frequently the cause of resignations and reduced hours, he set out to help his employees secure quality care that met their needs.

Conveniently, an existing center a few blocks from his corporate office was for sale; Jerry now offers employees a 50% discount and guaranteed spots in a child care center that better fits the work schedules of retail employees. He has no doubts that being able to offer this benefit has helped recruit and retain employees. “Our competitors have tried to lure away some of our talented employees,” he says, “but thanks to our child care benefit most of them will not even consider leaving.”

Benefits also make it easier to keep good employees in the child care center. Pooling employees from multiple businesses allows him to offer subsidized health insurance, a retirement plan with an employer contribution, and supplemental insurance to employees at the daycare.

Jerry is now a strong advocate for child care as a workforce improvement strategy. It is the primary business challenge he expects to face in the next few years. He is working with state legislators in Iowa to develop a scalable model where a handful of small- and mid-sized businesses co-own or contract with a center to meet the needs of their collective employees. Since child care is needed everywhere, any excess capacity can be offered to the public. His child care center has openings for up to 130 children and currently only about 20% are needed for his employees. The remainder are filled by other families in the community.

Technical Appendix

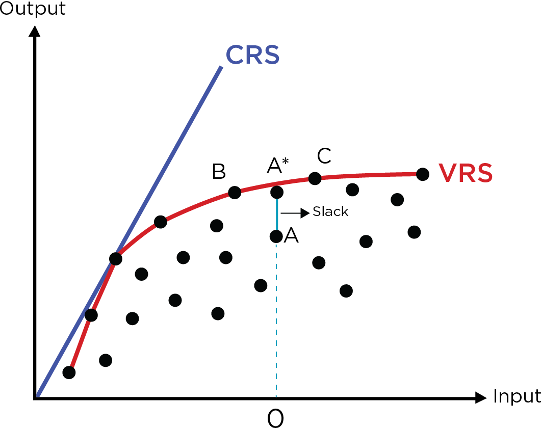

We estimate the technical efficiency of each state in turning child care and early learning funding into quality, affordable, and available child care openings. The efficiency is estimated using output-oriented Data Envelopment Analysis (DEA), which is a non- parametric, linear programming technique that forms a piecewise linear convex hull around the observed data points to determine which observations are the most efficient among those observed and which states lie within the frontier and are observed to be less efficient. This technique does not make strong assumptions about the production technology or any error term. This generates an overall efficiency measure for each state as well as a slack or waste measure for each of the outputs.

The diagram to the right shows a two-dimensional DEA model with one input and one output. Each dot represents a decision-making unit, or state. If we assume constant returns to scale the efficient frontier would be the blue line. If we allow the production process to have variable returns to scale, the red curve represents the efficient production frontier as identified by the states. State A is determined to be inefficient in this model since it is below the efficient frontier. If State A was efficient, we would expect them to produce output level A* with the quantity of inputs they are using. The efficiency score would be the ratio of the distances 0A/0A* (how much they are producing relative to what we think is possible) and the slack measure would be the difference between A* and A (the output lost because they are not currently efficient). This process also identifies states B and C as benchmarks to help identify operational changes within A that could lead to more efficient production.

Rather than an easy to see two-dimensional model, we estimated a 10-dimension model with three outputs and seven inputs. Each of the three outputs for the state is an average of four standardized metrics resulting in output measures (z-scores) ranging from -2.45 to 1.74.

DATA ENVELOPMENT ANALYSIS (DEA)

The measures for quality are:

- Number of pre-K teachers / number of other child care workers (employees and self- employed).

- Cost of toddler in home care center/ cost of toddler in child care facility.

- Pre-K spending per student / K-12 spending per student.

- Head Start spending per student / K-12 spending per student.

When these ratios are larger, we expect the early learning and daycare programs in the state to offer a more enriching educational experience for children. More trained pre-K teachers and higher spending in pre-K and Head Start programs should lead to higher quality. We also expect higher cost of toddler care in home centers to reflect higher standards in the state. Admittedly, these quality measures are imperfect. We would like to use data on social and emotional health and academic readiness of incoming kindergartners to measure the quality of early learning, but that data is not readily available in any systematic way that allows state program quality comparisons.

The measures of affordability are:

- Annual cost of infant in center / Annual housing cost (average of mortgage and rent).

- Annual cost of infant in center / Average annual tuition at state university.

- Annual cost for infant in center as a percent of median single parent income in state.

- Annual cost for infant in center as a percent of median married couple income in state.

Each of these ratios has the annual cost of an infant in a center as the numerator and different denominators to reflect costs in the state and incomes to reflect ability to afford. The higher these ratios are, the more unaffordable care is in the state. Since we wish to measure affordability, we multiplied each by -1 when calculating the average z-score.

The measures of accessibility are:

- Total workers in childcare / young (under age 5) residents in state

- Percent of families in state NOT missing work to care for kids as reported in Household Pulse Survey waves from September 2022 through April 2023.

- Number of children in paid care arrangements / Number with non-parental care providers

- Percent of children with parents who did not switch jobs due to care arrangements (as reported in the Kids Count Data Book).

The higher each of these measures is, the more accessible child care is considered to be in the state.

The inputs are dollars per young resident from each of the following funding sources:

- Child Care and Development Block Grant (CCDBG)

- State matching dollars to child care assistance program

- Head Start spending

- Child Care Dependent Tax Credit

- Household expenditures on child care

- State dollars on pre-K programs

- Philanthropic grants to child care centers within the state.

We recognize this does not capture spending by corporations on child care facilities for their employees. Unfortunately, this data is not readily available, and we know corporations are increasingly getting involved in child care in the tight labor markets. However, to the degree that corporations use their associated non-profit foundations to fund child care, those financial flows should be captured in the philanthropic data.

Eight different output-oriented DEA models were estimated. We estimated constant returns to scale (the ratio of inputs to outputs are fixed) and variable returns to scale (the ratio of inputs to outputs changes as production levels change) with one-stage and two-stage slack calculations. Each of the four models was estimated on the full input set and a simplified input set that aggregated inputs by source: Government, Philanthropy, and Household.

The eleven states identified as perfectly efficient in each of the eight models are the gold category. The remaining states were put into two categories using hierarchical clustering of the technical efficiency scores from the eight models.

The slack measures, which identify output forgone due to inefficiency, were captured and a regression model using square root lasso variable selection techniques was run for each of the output slacks to determine which policy options are most strongly associated with each of the outputs. Variable selection was made minimizing the AICC and again minimizing the EBIC measure. Variables are only reported as related if they were identified in both models with a two-tailed significance level of less than 0.10.

The full list of policy options included in the lasso algorithm are in two categories below. The first category is demographics. This label is used a bit loosely, but it includes any features about the state’s population or program that the current policymakers cannot change or control. The other category is state policy metrics, which are features of the current state policy that can be adjusted.

Demographics

- Percent of kids with no stay-at-home parent

- Average grant size

- Number of grants per funder

- Number of grants per recipient

- It’s possible a few large funders or recipients have different influences than many smaller funders and grant recipients within a state.

- Annual mortgage cost

- Daycare center/ home care providers that received COVID funding.

- We believe this captures the professional support and organization of home care providers in a state. The lower the ratio, the more home care providers are qualifying for federal pandemic funding.

- Percent of kids with parental job change due to child care (not included in accessibility model)

- Percent of kids in 10+ hours non-parental care per week

- Ratio of federal tax returns in state with child care credit/returns with dependent credit

- We believe this is capturing some differences across states in income tax policy and the proportion of employers in the state who offer flexible spending accounts. If parents have the option to use flexible spending accounts that is generally more beneficial than taking the dependent care tax credit.

- Did the state pay reimburse at rates greater than 75th percentile cost in 2001?

State Policy Metrics

- Percent of children eligible for subsidy

- Percent eligible who do not get subsidy due to lack of funding

- Minimum Copay for subsidized family

- Maximum Copay for subsidized family

- Number of NIEER (National Institute for Early Education Research) quality benchmarks met plus an indicator for each of the 10 benchmarks

- Does state use TANF for child care?

- Does state require a local match?

- Is program eligibility determined by state or local?

- Does state have pre-K program? Are 3-year-olds included?

- Pre-K funding per student

- Indicator variable for each approved subsidy use: HS, GED, Higher Ed, ESL, job training, basic adult ed, job search.

- Indicator variable for each population prioritized for subsidy: TANF recipients, homeless families, children under CPS supervision, very low income.

- Indicator for populations exempt from co-pay: CPS supervision, teen parents, special needs.

- Indicator variables for each category of weekly work requirement: <15 hours, 15-20,21-25,26-30.

- Number of months subsidy continues after job loss.

- State agency regulating and administering child care programs (4 indicator variables)

The data used in the analysis come from the following websites:

- https://nieer.org/state-preschool- yearbooks/2019-2

- https://nieer.org/wp-content/uploads/2020/11/ TOC_and_Full_Appendices_2019.pdf

- https://nieer.org/state-preschool-yearbooks- yearbook2021

- https://nwlc.org/wp-content/uploads/2021/05/ NWLC-State-Child-Care-Assistance-Policies-2020.pdf

- https://www.ced.org/assets/reports/Child careimpact/181104%20CCSE%20Report%20 Jan30.pdf

- https://info.Child careaware.org/hubfs/ Demanding%20Change%20Appendices.pdf?utm_ campaign=Budget%20Reconciliation%20Fall%20 2021&utm_source=website&utm_content=22_

- https://www.dropbox.com/s/tj804vy5bespmcj/ KidsCountDataBook-2023.pdf?dl=0

- https://nwlc.org/wp-content/uploads/2021/05/ NWLC-State-Child-Care-Assistance-Policies-2020.pdf

- https://maps.foundationcenter.org/home.php

- https://www.acf.hhs.gov/sites/default/files/ documents/opre/state-2019-ccdf-policies- graphics-dec-2020.pdf

- https://www.ffyf.org/issues/ccdbg/ccdbg-state- fact-sheets/

- https://www.census.gov/data/experimental-data- products/household-pulse-survey.html

As well as employment data from the data tools in JobEQ by Chmura Analytics.

ENDNOTES

- Child care Aware. (Undated). American Rescue Plan Act (ARP).

https://www.Child careaware.org/our-issues/public-policy/american-rescue-plan-arp-act/ - Kashen, J., Valle Gitierrez, L., Woods, L, and Milli, J. (2023, June 21). Child Care Cliff: 3.2 million children likely to lose spots with end of federal funds.

https://tcf.org/content/report/child-care-cliff/?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosam&stream=top - The Annie E. Casey Foundation. (2023). Kids Count Data Book: State Trends in Child Well-being. Baltimore, MD. Retrieved from

https://www.aecf.org/resources/2023-kids-count-data-book - Cain Miller, C. (2021, September 21). ‘Can’t Compete’: Why Hiring for Child Care Is a Huge Struggle. The New York Times.

https://www.nytimes.com/2021/09/21/upshot/child-care.html - For those interested in more on the topic, one such work is: Halbach, Johnson (2015). “Childcare Market Failure,” Utah Law Review, 3, 659-719.

https://econpapers.repec.org/paper/osflawarx/7zxsd.html - https://ukcpr.org/sites/ukcpr/files/research-pdfs/PolicyInsights3.pdf

- Ruppanner, L., Moller, S., & Sayer, L. (2019). Expensive child care and short school days= lower maternal employment and more time in Child care? Evidence from the American time use survey. Socius, 5, 2378023119860277.

- Morrissey, T.W. Child care and parent labor force participation: a review of the research literature. Rev Econ Household 15, 1–24 (2017).

https://doi.org/10.1007/s11150-016-9331-3 - Esping-Andersen, G., Garfinkel, I., Han, W. J., Magnuson, K., Wagner, S., & Waldfogel, J. (2012). Child care and school performance in Denmark and the United States. Children and youth services review, 34(3), 576-589.

- Chaudry, A., & Sandstrom, H. (2020). Child care and early education for infants and toddlers. The Future of Children, 30(2), 165-190.

- Pianta, R. C., Barnett, W. S., Burchinal, M., & Thornburg, K. R. (2009). The effects of preschool education: What we know, how public policy is or is not aligned with the evidence base, and what we need to know. Psychological science in the public interest, 10(2), 49-88.

- Barr, A., & Gibbs, C. R. (2022). Breaking the cycle? intergenerational effects of an antipoverty program in early childhood. Journal of Political Economy, 130(12), 3253-3285.

- Lee, S. Y., Kim, R., Rodgers, J., & Subramanian, S. V. (2021). Treatment effect heterogeneity in the head start impact study: A systematic review of study characteristics and findings. SSM-Population Health, 16, 100916.

- Johnson, R. C., & Jackson, C. K. (2019). Reducing inequality through dynamic complementarity: Evidence from Head Start and public school spending. American Economic Journal: Economic Policy, 11(4), 310-349.

https://www.nber.org/papers/w23489 - Blanden, J., Del Bono, E., Hansen, K., & Rabe, 828 (2022). Quantity and quality of child care and children’s educational outcomes. Journal of Population Economics, 35(2), 785-828.

- Hotz, V. J., & Wiswall, M. (2019). Child care and child care policy: Existing policies, their effects, and reforms. The ANNALS of the American Academy of Political and Social Science, 686(1), 310-338.

- Herbst, C. M. (2023). Child care in the United States: Markets, policy, and evidence. Journal of Policy Analysis and Management, 42(1), 255-304.

- Sawhill, I. (2023 June 30). Why we need Head Start. It’s not why you think.

https://www.brookings.edu/articles/why-we-need-head-start-its-not-why-you-think/?utm_campaign=Economic%20Studies%20Bulletin&utm_medium=email&utm_content=271267608&utm_source=hs_email - The Household Pulse Survey is an experimental data survey administered by the Census Bureau since April 2020. The data, questionnaires, and technical information on the survey can be found at

https://www.census.gov/data/experimental-data-products/household-pulse-survey.html. - Gonzales, M. (2023, January 26). Onsite Child Care: Working Parents Want More of It. SHRM

https://www.shrm.org/resourcesandtools/hr-topics/pages/onsite-child-care-working-parents-want-more-of-it.aspx - https://www.whitehouse.gov/briefing-room/statements-releases/2023/04/18/fact-sheet-biden-harris-administration-announces-most-sweeping-set-of-executive-actions-to-improve-care-in-history/

- https://www.whitehouse.gov/briefing-room/statements-releases/2023/07/11/fact-sheet-vice-president-harris-announces-actions-to-lower-child-care-costs-and-support-child-care-providers/

- Weecare. (2022, February 15). Absenteeism is employers’ #1 Challenge—2023 Child care Benefits Forecast.

https://weecare.co/blog/posts/absenteeism-employers-top-challenge-in-2022-Childcare-benefits-forecast-2021-year-in-review/ - Fund, S. and Redington, S. (2023, January 4). Employer-Supported Child Care—A ‘How-To’ gude to retain talent and boost performance.

https://hrdailyadvisor.blr.com/2023/01/03/employer-supported-child-care/ - Gitlin, S., Gummadi, A., Krivkovich, A., and Modi, 1. (2022, May). The child care conundrum: How can companies ease working parents’ return to the office?

https://www.mckinsey.com/featured-insights/sustainable-inclusive-growth/future-of-america/the-Child care-conundrum-how-can-companies-ease-working-parents-return-to-the-office - NIST. (2023, February 28). CHIPS for America Fact Sheet: Building a skilled and diverse workforce.

https://www.nist.gov/system/files/documents/2023/02/28/CHIPS_NOFO-1_Building_Skilled_Diverse_Workforce_Fact_Sheet_0.pdf - We use child care expenditures during the school year to primarily capture costs of caring for children too young to attend school rather than summer care for school age children.

- The First Five Years Fund. (2023). 2023 State Fact Sheets.

https://www.ffyf.org/issues/ccdbg/ccdbg-state-fact-sheets/ - This is one of the ten NIEER quality benchmarks.