Key Takeaways

• The playing field between entrepreneurs in the Heartland and non-Heartland states is very uneven.

• The Heartland produces over 35 percent of the U.S. GDP and 33 percent of new firm creations, but the region only has received about 10 percent of the venture capital investment since 2016.

• Female founded Heartland firms received less than one percent of total venture capital in the U.S. in the past few years.

• The big recipients of venture capital in 2020 were later stage firms- so while the amount invested is surprising in a pandemic year, it was concentrated in more mature firms.

In a year where nothing was normal and many small businesses faced one existential crisis after another, venture capitalists found uses for a record amount of capital despite working remotely and completing fewer deals in 2020. As we look to entrepreneurs and young firms to help our economy gear up for post-pandemic recovery, it is informative to look at where the venture capital1 (VC) is going, and where it’s not.

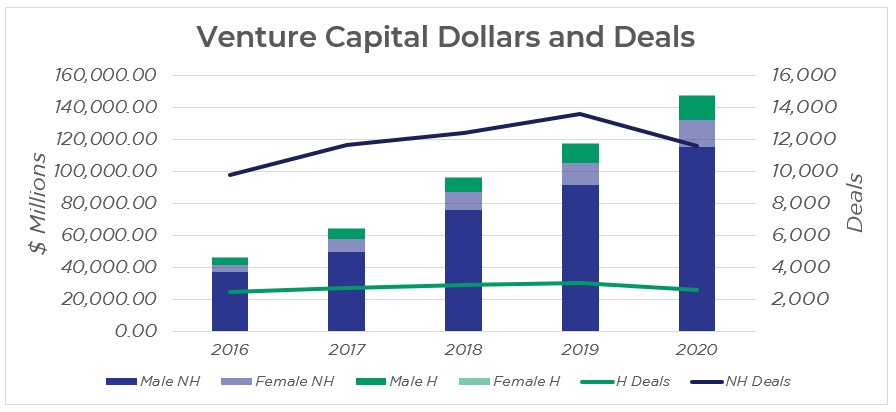

Figure 1

First, the good news: The total dollars invested increased despite the number of deals declining to pre- 2017 levels. VC investors recognize the potential of young firms and provide an ever-increasing amount of capital to fund the next generation of innovation and growth in American ingenuity.

The not so great news: Venture capital is not equally available to all worthy business ideas. It is well documented that venture capital, is highly concentrated in a handful of hotspots both globally and within the U.S. Figure 1 shows that VC dollars among U.S. firms are in the Non-Heartland2 region to male entrepreneurs and this has not varied over the past five years. Despite producing over 35 percent of the U.S. GDP and 33 percent of new firms founded, the Heartland has received only about 10 percent of the VC investment since 2016. Firms founded by females3 received 11.4 percent of VC investments in 2020. Of these female-founded firms, those in the Heartland received less than 0.9 percent of VC investment last year. A recent article in Fortune further differentiated between fully female owned and at least one female founder and found females without a male co-owner receive much less funding.

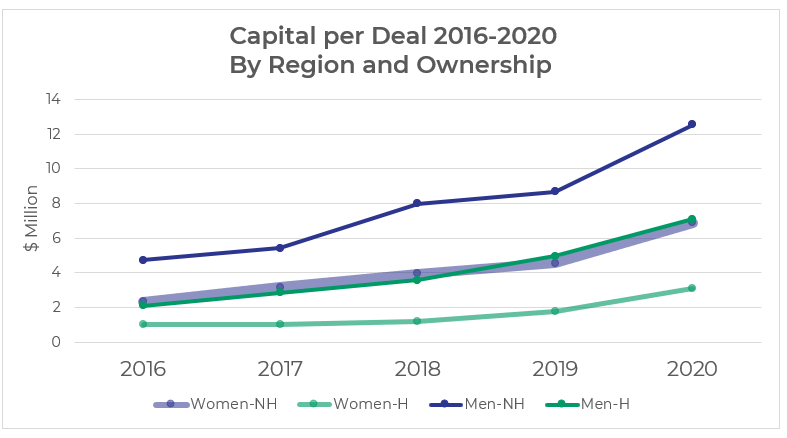

Nationally, female founded firms received an average of $3.0 M in capital per completed deal over the past five years, with those in the Heartland receiving an average of only $1.7M. Female-founded firms in Non-Heartland regions received, on average, a higher capital investment ($4.4M) than a male-founded firm located in the Heartland ($3.7M.) There is no statistically significant change in the share of investment dollars or deals going to females or Heartlanders in the last five years when evaluated with a Chi-Squared distribution test of annual data or testing for a trend using quarterly data. It may be that the geographic disparities in startup capital investments are even more profound than the well-documented gender disparities.4 The implications of this are troubling since entrepreneurship is a necessary growth strategy for rural America.

Figure 2

This regional disparity could be due to VC firms being disproportionately concentrated in a few geographic areas, largely in Non-Heartland regions – where VC investments have been successful in the past.5 There may be a proximity advantage of young firms in these VC-intensive regions. That is, VC firms may disproportionately invest in local startups as they can more easily monitor performance. While there are some reasons to think this trend is changing and the the geographic implications of funding opportunities may be shrinking as a result of the pandemic transition to remote work, the enormous discrepancy that currently exists merits intentional efforts to help close the gap in VC investments between the Heartland and Non-Heartland regions and to direct more capital to entrepreneurs in under-represented groups.

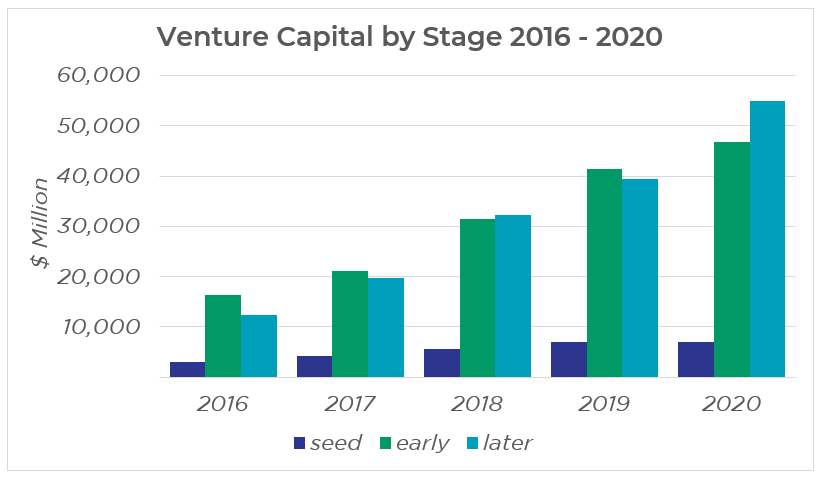

Figure 3

We also consider how the funding was distributed by the stage of funding. Not surprising, a larger percentage of the venture capital invested in 2020 was directed to more mature young firms that were seeking later funding stages, and a smaller share went to firms still in the proof of concept or seed funding stage.6 Figure 3 shows that while all stages of startup capital have increased consistently over the last five years, seed funding leveled off last year and later stage funding grew to exceed early stage funding in 2020.

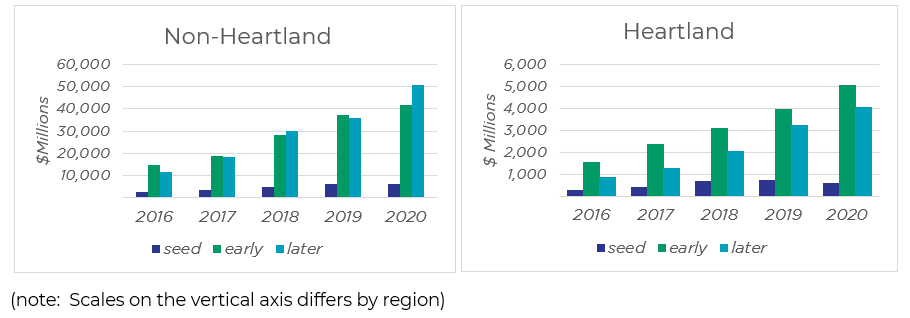

Figure 4

If we compare the stages of funding for the Heartland and Non-Heartland regions, we see a larger share of Heartland funding goes to early stage deals while Non-Heartland firms get more later stage funding. It is possible that firms in the Heartland are inherently smaller or less complex and, therefore, less likely to need later-stage funding. Alternatively, the successful firms in the Heartland could be acquired or relocated to be proximate to their investors in the Non-Heartland regions. It could also be that the Heartland has a less mature entrepreneurial eco-system, and the later stage funding will increase as the eco-system grows.

(We acknowledge that later stage funding rounds are likely to raise larger amounts of capital and this may explain part of the discrepancy in funding per deal we discussed earlier.)

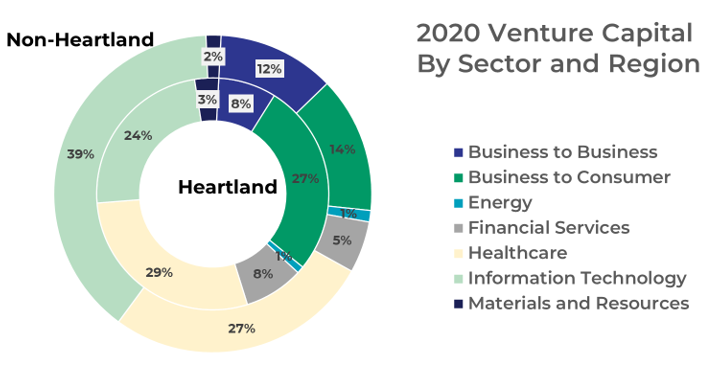

Figure 5

Recent venture capital data also reveals geographic variation in venture capital by industry sector. Heartland firms receiving funding are concentrated in different sectors than elsewhere. Figure 5 shows how the distribution of venture capital across industry sectors in the Heartland (inner circle) compares to the rest of the country (outer circle.) A Chi-Squared test comparing the distributions across sectors confirms that Heartland venture capital goes more to Business-to-Consumer and materials firms and less to information technology and Business-to-Business businesses.

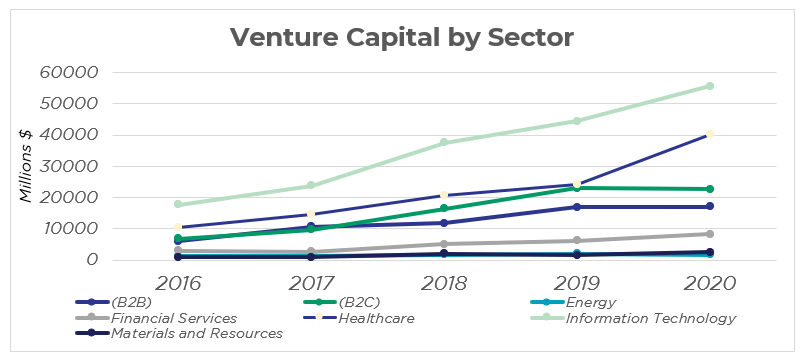

Figure 6

Looking at national data by sector for the last five years we see the sector differences are not a result of 2020 pandemic disruptions. The start-up capital across sectors nationwide has been increasing more rapidly in Information Technology than any other sector from 2016 – 2019; however, the Healthcare sector logically saw a more dramatic increase in 2020.

We recognize there are good reasons venture capital has historically been concentrated along the coasts and it’s unlikely ever to be as ubiquitous as gas stations, but there are no compelling arguments to suggest the current allocation of capital is ideal from either an economic development or equity perspective. How can we help VC find a way to the Heart(land) of America? Where do we go from here?

Here are four ways to increase venture capital in the Heartland.

Intentional Investors

Now that the disparities are obvious, we implore venture capitalists to “vote with their dollars” to create the economy we want to live with for the next generation by getting the capital where it is most needed and most effective.

Geography Intentional investors should proactively consider a geographically focused investment strategy and seek investment opportunities outside of the usual big markets. There are already several VC groups that target specific markets.

Diversity Beyond target markets, female and BIPOC entrepreneurs have been underfunded and should be sought out. VC groups investing strategically to improve diversity and equity are also already up and running.

Improve State Tax Credits

Many states have encouraged local seed/angel funding with tax credits for investing in young firms with innovative potential. A recent academic report of 31 states finds the credits do indeed generate angel investment by attracting new investors to the field. But it comes almost exclusively from non-professional investors and flows to firms with lower growth potential. So far, there is no evidence they have the intended effect overall. The report provides survey evidence suggesting that tax credits coordination and administrative burdens make them unattractive to experienced professional investors even when they are investing in firms that may qualify. States should re-evaluate the requirements for angel investment tax credits to make sure they incentivize effective investments.

Empower New Accredited Investors

In addition to tax credits, more education on investing in startups should be conducted so that more accredited investors in the Heartland are aware and informed of potential investment opportunities. With the lack of proximity to innovation and startup hubs in Silicon Valley, accredited investors in the Heartland currently may be more comfortable investing in other asset class such as real estate. Programs to help them invest in and support entrepreneurs will help the Heartland.

Develop Investor | Entrepreneur Networks

Make it easier for early startups to plug into VC. VC firms should have connections with the entrepreneurship ecosystems around the country to help connect promising startups that are ready for capital with investors who know how to evaluate (and fund) their potential.

Do you have other ideas to help entrepreneurs and venture capital thrive in the Heartland? Join our conversation as we work to transform the economic future of the Heartland.**

Follow us on LinkedIn, Facebook (Heartland Forward) or Twitter @HeartlandFwd.

This blog is a collaborative work of Julie Trivitt and Katie Milligan from Heartland Forward, and Yee-Lin Lai from the Walton Family Foundation and the NWA Council.

ENDNOTES

- In this post we use the term venture capital to refer to any investment in a young firm in exchange for equity or ownership. We have it broken into three categories: 1.) angel or seed funding, 2.) early stage, and 3.) later stage.

- The Heartland Region consists of Alabama, Arkansas, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Tennessee, Texas, and Wisconsin.

- Data includes all firms with and female founders (including companies with male and female co-founders).

- While we would have liked to consider race/ethnicity of entrepreneurs, too, data limitations prevented such analysis.

- Read full report “Buy Local? The Geography of Successful and Unsuccessful Venture Capital Expansion” at Harvard Business School Finance Working Paper No. 1420371

- Seed Funding: When any investor type provides the initial financing for a new enterprise that is in the earliest stages of development. PitchBook will only designate an equity raise as seed financing when it is explicitly referenced as a seed deal in sources. Early stage VC: An early stage round of financing by a venture capital firm in a company. Early stage is usually a Series A to Series B financing deal and occurred within 5 years of the company’s founding date. If there is no series associated with the deal and the deal occurred within 5 years of the company’s founding date, Pitchbook categories the deal as early stage VC. Later stage VC: A later stage round of financing by a venture capital firm into a company. Later stage is usually Series B to Series Z+ rounds and/or occurred more than 5 years after the company’s founding date. For this analysis, we classify Series B deals as early state and Series C – Z+ as Late state funding.