Executive Summary

Young Firms and Regional Economic Growth demonstrates how knowledge-intensive and Main Street entrepreneurs are critical to long-term economic success. Metropolitans and micropolitans that started with stronger entrepreneurial ecosystems, as measured by the share of total employment at firms age five years or fewer (young firm employment share) and by the share of employment at those young firms with a bachelor’s degree or higher (young firm knowledge intensity), saw notably faster employment growth between 2010 and 2017 in the United States.

Most Heartland communities did not participate fully in entrepreneurial-driven job growth. There are multiple causes for the subpar rate of job creation in the Heartland besides low engagement in entrepreneurial activities; lower educational attainment with less emphasis placed on innovation tied to research and development stands out among them. However, no other single factor can claim a higher explanatory power than entrepreneurial activities.

Huge financial incentives to lure manufacturing facilities or other operations into a region is no longer cost-effective. The key to long-term economic success lies in developing environments that are conducive for entrepreneurs to start and scale up their firms. Communities must take a holistic approach to build their entrepreneurial ecosystems, and they must be inclusive. It is the ability to connect and engage the elements of an ecosystem as efficiently as possible to maximize job creation. Demographers like to say that “demography is destiny.” Young firms and the entrepreneurial ecosystems that spawned and nurtured them determine the economic destiny of communities.

While the main focus of this report is the relationship between our two young firm activity measures (young firm employment share and young firm knowledge intensity) and future economic growth, we also take stock of young firm activity in metropolitan and micropolitan areas by generating a composite index based on the two young firm activity measures; a discription of the index construction and a discussion of the top performers are provided in the full text and in the Research Summary below. In this section, we provide interactive maps that allow users to see how areas perform in the composite index and its component measures.

Hover over or click on an area’s dot to see its composite index ranking, as well as its rankings for young firm employment share and young firm knowledge intensity. To download the underlying data, click the download button at the bottom-right of the map, and select “Data.”

Comparing Young Firm Activity Across Metropolitan and Micropolitan Areas

Research Summary

The Role of Young Firms in Economic Growth

Young firms are defined as new business entities that are five years old or less—these are distinct from young establishments, such as a new Burger King, which are new locations of an existing firm. Young firms play a key role in economic growth at the national, metropolitan and micropolitan levels. For example, in 2016, startups created roughly 2.6 million jobs, according to the Census Bureau’s Business Dynamics Statistics. For comparison, firms of all other ages lost 267,000 jobs on net (job creation less job destruction). This differential is relatively consistent over the past several years. An estimated 50 percent of jobs established among an annual cohort of startups will be lost within the first five years due to business exits. It is the rapid growth of a relatively small number of young firms—mostly knowledge-intensive— that is responsible for the long-enduring job creation. High growth firms1 compensate for the majority of losses associated with an annual startup cohort so that it retains 80 percent of its original employment after five years.2

Furthermore, the young firm share of employment is a useful measure of the broader entrepreneurial awareness, support and capacity in a geographic area. An entrepreneurial ecosystem includes mutually supporting factors and operators that facilitate productive entrepreneurship within a specific geography.3 At the core of an entrepreneurial ecosystem is the network of entrepreneurs, and a range of factors supporting the ecosystem, including finance, talent, leadership, knowledge, support services and the social capital binding them together.4

Some entrepreneurship aims to exploit local market demand and indirectly provides employment and income for founders and their family members. Many call this “Main Street” entrepreneurship. Nevertheless, service sector family-based entrepreneurship can employ both a sizable number of family and non-family members. Communities with a high young firm share of private employment, even if largely “Main Street” entrepreneurship, have a highly effective entrepreneurial ecosystem that creates more new firms and sustains them in the early stages of scale-up.

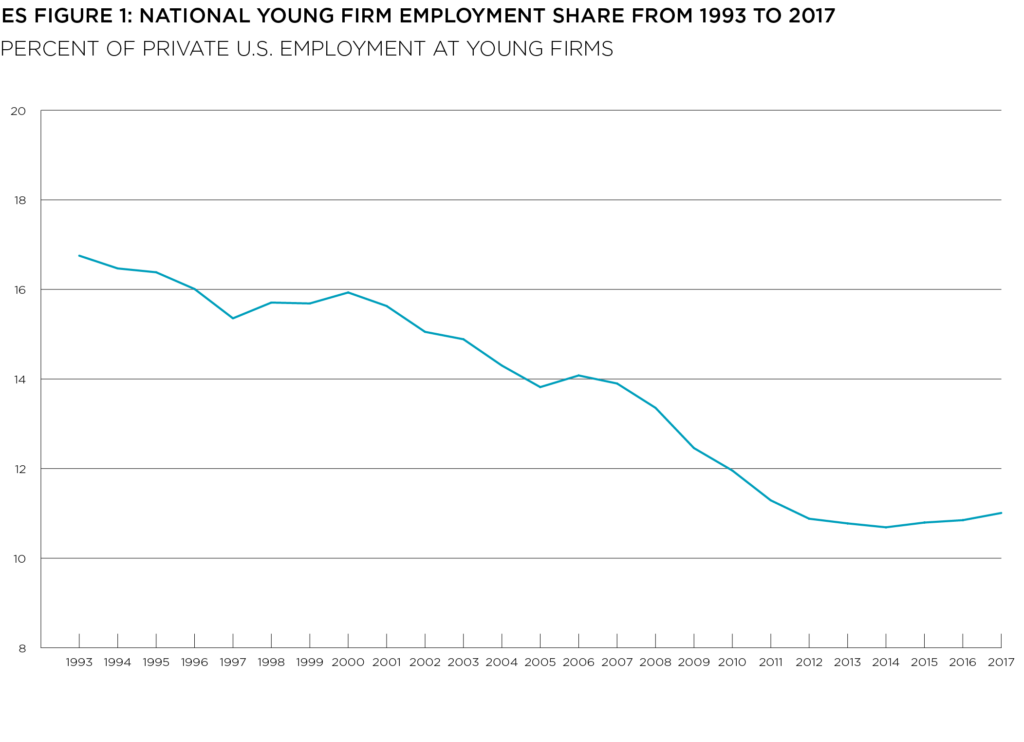

ES Figure 1 illustrates how the U.S. young firm employment share has declined in recent decades and the trend explains some of the lost dynamism in the U.S. economy overall. Following moderate stability during the 1990s, the U.S. saw a notable decrease in the share that lasted roughly 15 years. Today, approximately one-third fewer workers hold jobs at young firms than in 2000. The reason for the decline is debated and could be the result of phenomena ranging from societal changes in the perception of entrepreneurship to increased student loan debt to larger firms—especially in technology sectors—dominating their industry longer.

The percentage of total employees at young firms with a bachelor’s degree or above can provide a measure of the sophistication or knowledge intensity of a firm. The young firm knowledge intensity supplies information on the aspirations of the founders and the characteristics of the industry in which they are engaged. For example, young firms providing professional, scientific and technical services will have a higher proportion of staff with bachelor’s and advanced degrees as they create and deliver the services. They will have a higher propensity to go after non-local markets.

Most of the founders of knowledge-intensive firms desire to disrupt regional, national and international markets as they scale up and have sizable local employment and wage impacts. Research universities and government labs are central to a knowledge-based entrepreneurial ecosystem. Both are key ingredients for the formation of a knowledge-based entrepreneurial ecosystem that commercializes research in the form of spinout firms and through licensing to newly established firms within the region. This form of “transformational” entrepreneurship can involve creating new markets or fundamentally altering existing ones. Knowledge-intensive young firms have a higher probability of achieving middle-market status where they generate rapid job gains for their communities.

Therefore, it is important to examine both the young firm share of total employment and knowledge intensity to provide a comprehensive picture of entrepreneurial activity.

Regional Trends

Young firms are not uniform across geography. Like other types of economic activity, young firms are clustered, concentrated and spiky. To get at such geographic variation, we create a composite measure of the entrepreneurial ecosystem and its ability to create jobs and economic growth. By combining the young firm share of employment and young firm knowledge intensiveness for 2017, the latest year available, we create this composite index. We apply equal weights to the young firm share of employment and young firm knowledge intensiveness. The metropolitan statistical area with the highest average score on the two measures is rebased to equal 100. If you score high on both measures, your prospects for job creation appear to be high.

Metropolitan Trends

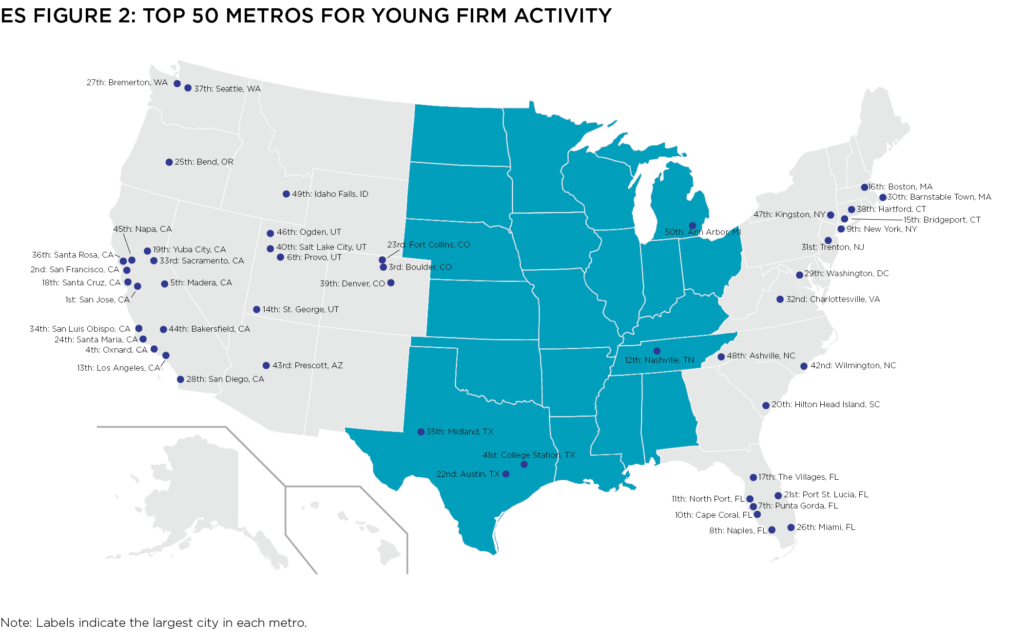

Metropolitan areas are regions containing a central city of more than 50,000 in population and surrounding counties with an economic connection to the central city. There are roughly 380 metropolitan areas in the United States; we plot the 374 metropolitans for which young firm employment and young firm knowledge intensity data are available in ES Figure 2, with dot colors indicating metros’ ranking in the composite index. Hover over or click on a metropolitan to see its performance in the composite index and the two index components. The top three are all major tech hubs with San Jose-Sunnyvale-Santa Clara, California, taking the lead as a center for startups and perhaps the nation’s most fully developed entrepreneurial ecosystem, ranking first with a score of 100. Nearby, San Francisco-Oakland-Hayward, California, is a close second with an index score of 98.2, just 1.8 percentage points lower. The San Francisco metro area has a higher young firm share of employment than the San Jose metro. Boulder, Colorado, is third in this measure at 91.3.

The next metros are not as obvious as our top three. Oxnard-Thousand Oaks, California, has respectable scores on both components and is fourth overall. The biotech firm Amgen is headquartered in the metropolitan area. Madera, California, is fifth overall, courtesy of its first place in young firm share of employment. Provo-Orem, Utah, is sixth with an index score of 86.6. Punta-Gorda, Florida, is seventh and Naples-Immokalee-Marco Island, Florida, is eighth. The New York metro area is ninth and Cape Coral, Florida, is tenth.

The Heartland has five metros among the top 50 and 14 out of the top 100, a disappointing performance overall. Nashville-DavidsonMurfreesboro, Tennessee, was 12th and the highest-ranking Heartland metro. It combined respectable scores of 57th on the young firm share of employment and 18th on knowledge intensity to warrant its position. The Nashville metro is one of the true Heartland success stories.5 Austin-Round Rock, Texas, was 22nd in the composite measure. The University of Texas-Austin, a significant contributor of talent to Austin for generations, provides a strong research and commercialization anchor. Midland, Texas, was 35th, College Station-Bryan, Texas was 41st and Ann Arbor, Michigan was 50th. Again, most of these metros are established tech hubs like Austin, Nashville or similar college towns.

Micropolitan Trends

Micropolitan areas are defined as communities with an economic hub/central city of 10,000 to 50,000 people. Thus, they fall between rural and metropolitan areas. There are roughly 550 micropolitan areas in the United States. The population residing in micropolitans makes up 8.5 percent of the total U.S. population.

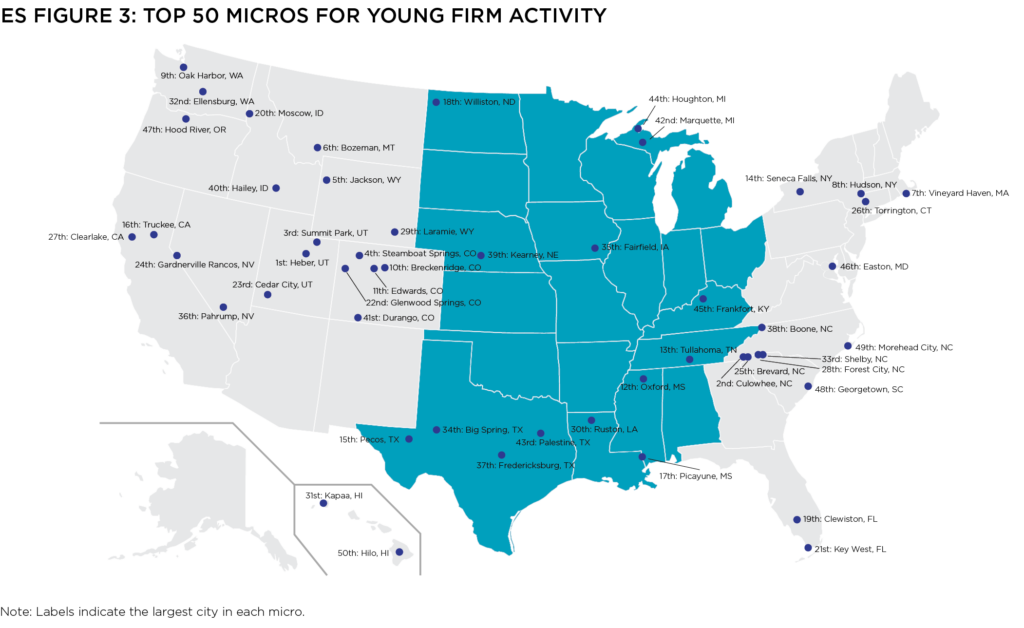

Using data from 2017, we applied the same methodological approach used in metropolitans to create the composite micropolitan index of the entrepreneurial ecosystem and its knowledge intensiveness. The two components are equally weighted. The top micropolitan areas of this ranking have been the leaders in job creation in the nation since 2010. We plot the top 50 micropolitans, by the composite index, in ES Figure 3.

Heber, Utah, captured the top position among micropolitans by combining its seventhranking score on the young firm share of total employment and 21st position on young firm knowledge intensiveness. The high level of engagement in starting new firms combined with knowledge-intensive sectors results in a nation-leading ability to create and sustain jobs. The 94.9 index score for Cullowhee, North Carolina, placed them in second. Summit Park, Utah, is third overall, primarily due to its strong performance on knowledge intensity and its solid position on the young firm share of employment. Steamboat Springs, Colorado, comes in fourth without making the top 10 on either of the two components. Jackson Hole, Wyoming-Idaho, is fifth, followed by Bozeman, Montana, in sixth. Vineyard Haven, Massachusetts, comes in seventh, Hudson, New York, is eighth, Oak Harbor, Washington, ninth and Breckenridge, Colorado, is tenth.

The Heartland has 14 micropolitans among the top 50 and 30 out of the top 100. If the Heartland achieved its proportionate share, there would have been 63 micropolitans in the top 100. The performance rankings highlight the lackluster growth in the Heartland micropolitans. Oxford, Mississippi, the highest-ranked Heartland micropolitan, comes in 12th. Oxford demonstrates the right ingredient combination—plans, and the ability to execute—and is a role model for other Heartland micropolitans to improve their economic performance and job creation. Additional Heartland micropolitans in the top 20 include: Tullahoma-Manchester, Tennessee (13th); Pecos, Texas (15th); Picayune, Mississippi (17th) and Williston, North Dakota (18th).

Importance of Young Firms in Determining Regional Job Growth

We conducted a statistical analysis to look at the importance of young firms and other factors that appear to affect job growth. Using data from the Census Bureau’s Longitudinal Employer-Household Dynamics Quarterly Workforce Indicators (LEHD-QWI) database, we created a dataset of private-sector job growth between 2010 and 2017 across all U.S. metropolitan and micropolitan areas. Utilizing our compilated data from the 2010 young firm share of employment and young firm knowledge intensity (the percent of employees at young firms with a bachelor’s degree or above), we tested the proportion of the job growth they can explain between 2010 and 2017. By controlling for a variety of factors during this period, we can better understand the importance of measuring the existing entrepreneurial ecosystem to determine the recent job creation seen across communities.

Both the young firm share of private employment and young firm knowledge intensity are essential factors to explain the variations in job growth across metropolitan and micropolitan areas. (See full report for statistical details).

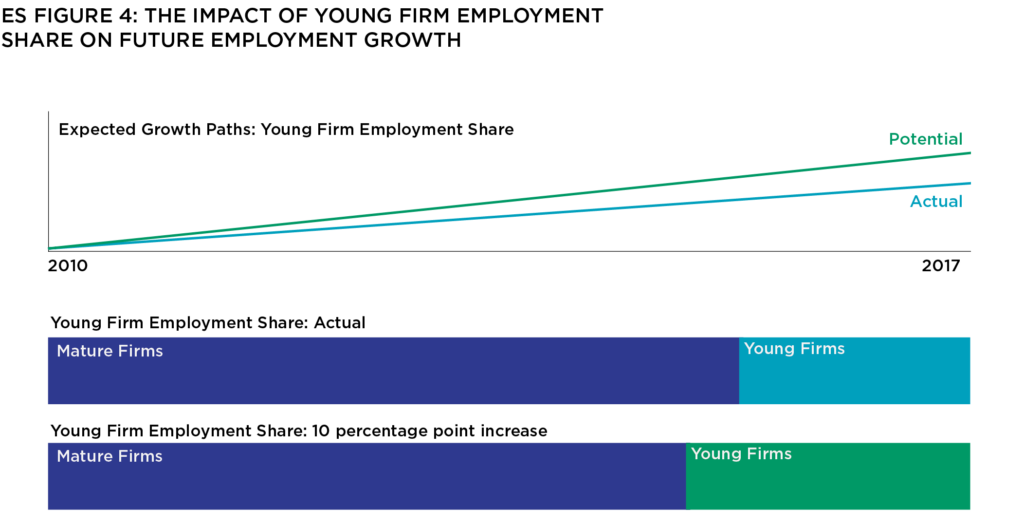

For metropolitans, the relationship between the young firm share of employment and employment growth shows that for every one percentage point increase in the share (e.g., an increase in the share from 8 percent to 9 percent), we can expect 2010-2017 employment growth to increase 0.5 percentage point. Given that the young firm employment share has a standard deviation of 3.6 percentage points and the average 2010-2017 employment growth is 12.6 percent, a 0.5 percentage point increase is sizable. For example: if a metro has an average 2010-2017 employment growth, we expect a one standard deviation increase in the young firm employment share to result in a 15 percent faster growth rate. ES Figure 4 demonstrates the impact of a 10-percentage point increase in the young firm employment share.

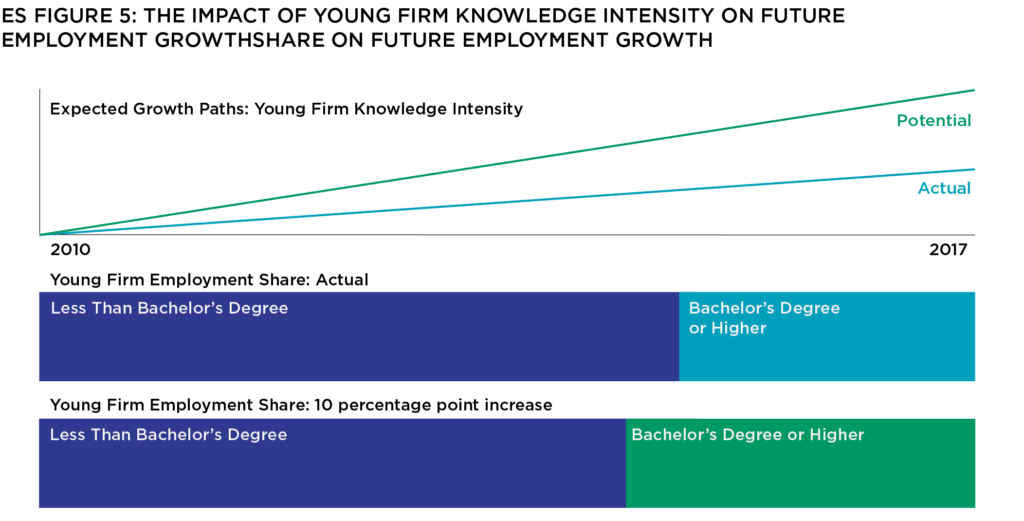

Furthermore, the estimated relationship between knowledge intensity and employment growth is a one percentage point increase in the young firm knowledge intensity leads to roughly one percentage point change in future employment growth. Given the standard deviation of the young firm knowledge intensity is 4.7 percentage points, the average-growing metro from 2010 to 2017 could expect a 34 percent faster employment growth if their 2010 young firm knowledge intensity were one standard deviation higher. ES Figure 5 depicts a 10 percentage-point increase in the young firm knowledge intensity.

The results for micropolitans are comparable to those of metropolitans. A one percentage point increase in the young firm share of employment is associated with a 0.6 percentage point greater job growth between 2010 and 2017. This share has a standard deviation of 3.9 percentage points. Looking at the average micro for 2010-2017 employment growth (7.6 percent), we would expect 31 percent faster growth if its young firm employment share had been one standard deviation higher in 2010.

Again, for micropolitans, a one percentage point increase in young firm knowledge intensity is associated with a 0.7 percentage point increase in job growth between 2010 and 2017. This implies that the average-growing micropolitan from 2010 to 2017 would have seen a 31 percent higher growth if its young firm knowledge had been one standard deviation higher in 2010.

What It All Means for Economic Growth and Development:

Our findings suggest there may be a misallocation of development resources, especially the incentives directed toward recruiting firms from other locations. Providing assistance and additional support services for budding entrepreneurs allows them the opportunity to scale-up their firms.

A more balanced portfolio approach that includes recruiting, retention and entrepreneurial support is necessary for the Heartland and beyond. Organic entrepreneurial-based economic development requires a long-term, patient and focused approach. So, where do Heartland and other communities that are lagging in entrepreneurial acumen begin? It is necessary to build an entrepreneurial ecosystem.

Below are steps that can and should be taken:

Improve Attitudes Toward Entrepreneurs

Creating positive attitudes towards entrepreneurial activities is an area that needs emphasis, especially in the Heartland. In most communities, entrepreneurs are not held in as high esteem as corporate managers.

Establish and Fund Entrepreneurial Support Organizations

Establishing and providing resources to entrepreneurial support organizations, whether they are called networks, connectors, enablers or ecosystem builders, are a necessary part of the process for creating the social capital that is required for success.

Enable Dealmakers

A particular form of social capital and connectors in entrepreneurial ecosystems has been isolated for its growing importance—“dealmakers.” Dealmakers are individuals with valuable social capital who can facilitate relationships that support new firm formation; while this could include financial connections, it could also be connecting entrepreneurs with similar ideas or an entrepreneur with a manufacturing firm to commercialize this product. Empirical research has provided strong evidence that these dealmakers are highly correlated with new firm births and scaling in locations across the country.6

New Real Estate and Service Provider Models

“Hard” infrastructure is still necessary. Physical spaces such as incubators and accelerators can ease the process of establishing firms and facilitating their growth.7 Other service providers need to explore alternative revenue models, such as taking a form of equity in new firms rather than charge them their standard hourly rates.

Demand University Entrepreneurial Engagement

Too few communities fully comprehend the importance of entrepreneurship and science, technology, engineering and mathematics (STEM) graduates created in their geography. Universities need to offer entrepreneurial education as part of their curriculum and provide commercialization program support for students and faculty.8 Communities must insist that universities see entrepreneurial ecosystem involvement as a critical component of their missions.9

Promote Early Stage Risk Capital Networks

An active effort focused on encouraging business angel investors to provide startup capital and smart money management needs to occur, especially because angels are looking to invest locally. More public sector funding and underwriting of operating costs for business angel networks can allow them to act as “dating agencies” and to educate accredited investors on the opportunities.

Position Government as Central Hub for Entrepreneurial Resources

The government can play an effective role as part of the entrepreneurial infrastructure. Since they are already part of the startup process, by issuing sales tax permits, corporate registration and licensing, government agencies can act as a central hub and facilitate access to resources available to entrepreneurs.

Link in Corporations

Corporate engagement is critical to successful entrepreneurial ecosystems and can be considered part of the infrastructure supporting them. Corporations might create spinoffs that would be impossible to incubate within their organizations.

Build and Enhance Quality of Place and Amenities

A growing body of research provides an empirical basis for the role quality of place, including arts and culture, plays in promoting the prosperity of place. The presence of the arts improves the image of a region and assists in making a stronger case for attraction and in fostering denser entrepreneurial ecosystems.10

ENDNOTES

- Decker, R. A., Haltiwanger, J., Jarmin, R. S.., & Miranda, J. (2014). The Role of Entrepreneurship in US Job Creation and Economic Dynamism. Journal of Economic Perspectives, 28(3), 3-24. https://doi.org/10.1257/jep.28.3.3

- Horrell, M. & Litan, R. (2010). After Inception: How Enduring is Job Creation by Startups? Kauffman Foundation Research Series: Firm Formation and Economic Growth. https://www.kauffman.org/entrepreneurship/reports/firm-formationand-growth-series/after-inception-how-enduring-is-job-creation-by-startups/

- Stam, E. (2015). Entrepreneurial Ecosystems and Regional Policy: A Sympathetic Critique, European Planning Studies, 23(9), 1759-1769. https://doiorg.argo.library.okstate.edu/10.1080/09654313.2015.1061484

- Feld, B. (2012). Startup Communities: Building an Entrepreneurial Ecosystem in Your City. New York: Wiley, (pp. 31-46). Wiley.

- DeVol, R.,. & Crews, J. (2019). Most Dynamic Metropolitans (pp. 74-75). Heartland Forward. https://heartlandforward.org/media/pages/most-dynamic-metropol itans/3246199322-1571712082/hf-most-dynamic-metropolitans.pdf

- Feldman, M., & Zoller, T. D. (2011). Dealmakers in Place: Social Capital Connections in Regional Entrepreneurial Economies. Regional Studies, 46(1), 23- 37. http://dx.doi.org/10.1080/00343404.2011.607808

- Miller, P. & Bound, K. (2011). The Startup Factory: The Rise of Accelerator Programmes to Support New Technology Venture. NESTA, Discussion Paper. https://www.bioin. or.kr/InnoDS/data/upload/policy/1310018323687.PDF

- Mason, C. & Brown, R. (2014). Entrepreneurial Ecosystems and Growth Oriented Entrepreneurship (pp. 3-33). OECD and LEED. https://www.oecd.org/cfe/leed/Entrepreneurial-ecosystems.pdf

- DeVol, R. (2018). How Do Research Universities Contribute to Regional Economies? Measuring Research University Contributions to Regional Economies. Heartland Forward. https://heartlandforward.org/media/pages/how-do-researchuniversities-contribute-to-regional-economies/567814433-1571712344/how-doresearch-universities-contribute-to-regional-economies-1.pdf

- Costello, D. (1998). The Economic and Social Impact of the Arts on Urban and Community Development. Dissertation Abstracts International, A: The Humanities and Social Sciences, 1998.